Everyone is talking about the most awaited event, “The Merge,” which will happen on September 15, 2022. You might even have come across this term on the internet today. But, do you know what this merge is all about?

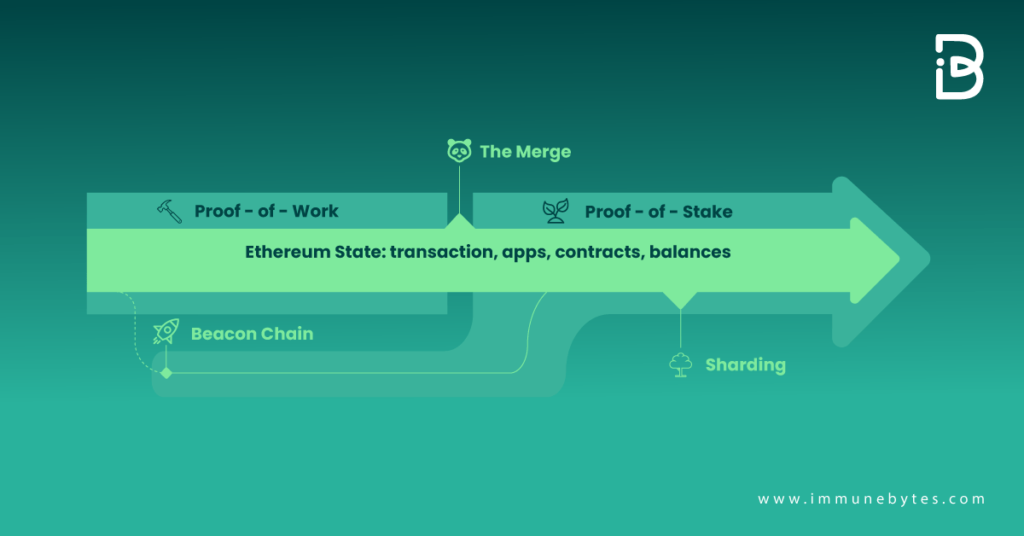

Ethereum is set to make the eagerly awaited switch from the proof-of-work (PoW) consensus method to the proof-of-stake (PoS)! It is predicted that it will set the stage for future scaling improvements, such as sharding.

How will this Merge prove to be a revolution for the blockchain industry? What else will it do? These are some of the questions that we will walk you through in this blog. So, without any further ado, let us get started.

First, the key takeaways!

- The Beacon Chain proof-of-stake network will combine with the current Ethereum mainnet.

- This will complete Ethereum’s shift to proof-of-stake and signal the end of the proof-of-work consensus mechanism.

- Ethereum’s energy use will be reduced by 99.95% due to the Merge.

We’re good to go now. Let us proceed.

When Is It Happening?

Table of Contents

September 15, 2022

The Merge upgrade of Ethereum is the most significant improvement so far. Extensive testing and bug bounties were conducted to ensure a secure transition to proof-of-stake consensus.

What is the Merge all about?

The Merge is the union between Ethereum’s new Beacon Chain proof-of-stake consensus layer and its current execution layer (the mainnet we currently utilize). Instead of using energy-intensive mining, it uses staked ETH to safeguard the network. This is an exciting step toward achieving the scalability, security, and sustainability goals of Ethereum.

It’s vital to keep in mind that the Beacon Chain first shipped apart from Mainnet. While the Beacon Chain operates concurrently with proof-of-stake, the Ethereum Mainnet, with all of its accounts, balances, smart contracts, and blockchain information, continues to be secured by proof-of-work. When these two systems eventually converge at the next merge, proof-of-stake will completely replace proof-of-work.

Let’s think about an analogy. If Ethereum were a spacecraft, it might not be ready for an interstellar journey. The neighborhood has constructed a new engine and a fortified hull using the Beacon Chain. It’s almost time to hot-swap the new engine for the old one mid-flight after extensive testing.

As a result, the existing spacecraft will incorporate the new, more effective engine, making it ready to travel significant distances and take on the cosmos.

Additional Resources: Difference between Mainnet & Testnet

Ethereum Mainnet Merge

We all know how Proof-of-Work has been able to secure the mainnet. Since we have learned about blockchain technology, we have been used to the Ethereum network. It began in July 2015 and consists of many balances, transactions, and smart contracts.

If you turn the pages of the history of Ethereum, you will find that developers have always been up and trying to prepare for a transition from a proof of work to a proof of stake system. It was in the year 2020 that, on December 1, they were able to create Beacon, which has always served to be a different blockchain to the mainnet, running in parallel.

The Beacon Chain has not handled transactions on the mainnet. Instead, it has agreed on active validators and their account balances to gain consensus on its state. Including execution layer transactions and account balances, the Beacon Chain will serve as the consensus engine for all network data following The Merge. The time for the Beacon Chain to decide on more is approaching after lengthy testing.

As of the Merge, the Beacon Chain will now be the official mechanism for producing blocks in the Merge. Valid blocks can no longer be created by mining. In its place, the proof-of-stake validators take on this responsibility and are in charge of processing all transactions’ legitimacy and submitting blocks.

The past is not lost. The complete transactional history of Ethereum will be unified as the mainnet and beacon chain are combined. Nothing needs to be done by you. Your money is secure.

What do you need to prepare?

Undoubtedly, The Merge is one of the most anticipated upgrades that will have a lot of long-term impacts on people. There are certain things that you need to do to be fully prepared for this event.

Let us talk about each of the things for everyone in detail.

Clients and holders

There is nothing that you need to do on your part to protect the funds that will be entering into this merge.

- If you are a holder of ETH or any other digital asset on this blockchain, you must relax and do nothing to your funds or wallets before the merge occurs.

- After switching to proof-of-stake, Ethereum’s complete history of its creation is still preserved and unchanged. You don’t need to do anything to upgrade. After The Merge, you will still be able to access any money that was in your wallet before The Merge.

- One of the most important things to note here is that hackers will do their best to attack you with scams and take advantage of this transition. So, as we approach the Ethereum Mainnet merge, ensure you never send your ETH to anyone to upgrade to ETH2. This is because there is no such token!

Additional Resources: What is EIP-1559?

Node operators and developers of dapps

Are you a staker who is interested in running your node setup? Then, these are the things that you need to be aware of to be fully prepared for the merge.

- You should run both the consensus and execution layer clients; after the merge, third-party endpoints for obtaining execution data won’t be available.

- You need to authenticate both layers with a shared JWT secret that will help them communicate securely. After the merge, your node will appear to be “offline” until both layers have been synchronized and authorized.

- Don’t forget to set up a fee recipient address so you won’t miss out on your MEV/ transaction fee tips. While your validator can continue to operate normally if a fee recipient is not specified, you forfeit any unburned fee tips and MEV that would have otherwise been received in the blocks that your validator suggests.

Non-validating node operators and infrastructure providers

If you fall under this category, the most significant change you will encounter with the Merge is the need to run clients for both layers.

An execution layer client like Geth, Erigon, Besu, or Nethermind is likely already running on your computer. An execution layer client was sufficient until the Merge received, correctly validated, and propagated blocks that the network talked about. After the merge, the legitimacy of the “consensus block” that an execution payload is placed in will also determine the legitimacy of the transactions contained therein.

Consequently, a complete Ethereum node after The Merge needs clients for both the execution and consensus layers. The new Engine API, which these two clients use to communicate securely, requires authentication using a JWT secret given to each client.

You need to take the following actions:

- Install clients on both layers.

- Use a shared JWT secret to authenticate execution and consensus with clients so they can communicate safely.

Dapp and Smart Contract Developers

Speaking of the Dapp and Smart Contract developers, this merge will impact them the least. However, there are some minute things that you, as a dev, must be aware of ahead of getting into the merge.

With the merge, so many changes come to a consensus as well. There are many other changes related to the following also.

- The structure of the block

- “Safe head and finalized blocks.”

- Timing of the slot or block

- Sources of on-chain randomness

- opcode changes

Recommended : Smart Contract Audit Services

What will happen after the merge?

This merge will mark the end of proof-of-work for the Ethereum blockchain and begin an era of an eco-friendly and way more sustainable Ethereum.

The Aftermath of the Ethereum Merge

Now that the post-Merge dust has settled, it would be easier to evaluate the aftermath of this Ethereum Merge that happened on 15th September 2022.

Following are some of the impacts of #themerge!

Decreased Energy Costs

One of the most prominent and immediate impacts of this Merge was on the energy usage of the network. As there was a shift from mining to staking, it did a lot of good for the environment.

However, many Ethereum miners have temporarily sought sanctuary on other networks, such as Ethereum Classic, which continues to run on the proof-of-work algorithm. The effect that the Merge will have on reducing total crypto output has been slightly muted by the migration of former Ethereum miners to these other chains.

Therefore, even if the existence of alternative proof-of-work chains partially mitigated the Merge’s immediate environmental effects, its overall impact on emissions continues to be favorable.

New Validators

With the new validator system of Ethereum, a new cast of characters was ushered. They were responsible for checking the chain so that it would run smoothly. However, this also paved the way for many newer concerns around the network’s centralization.

Reduced Issuance

The Merge’s effect on the issuance rate of ETH, the network’s native currency, has been the most noticeable on-chain effect.

The network has substantially lowered the amount of fresh ETH issued with each block since Ethereum switched to proof-of-stake. Due to a burning mechanism added with the network upgrade EIP-1559, there is a chance that Ethereum might become deflationary in the long run, which would imply that its token supply will eventually decline.

Since the Merge, ETH’s price has substantially decreased. However, lower supply has been hailed as one factor for ETH holders to maintain optimism: Since fewer ETH are in use, each token should potentially be worth more.

As the coin has two sides, so does this Merge. With the positives came the negatives as well. Some of them are as follows:

Ethereum Couldn’t Save Crypto

From a technical perspective, The Merge’the update Ethereum made to proof-of-stake consensus?went smoothly and without any significant issues. The status of the markets is one issue that its update on September 15 was unable to resolve. Despite all the hype, the Merge could not reverse a 10-month economic downturn, and the future for crypto assets is still bleak.

The Top 8 Myths That Need To Be Busted With The Ethereum Merge

With the Merge, a lot of misconceptions have come to be known. Do you know them all? These are:

- You require to stake 32ETH to run a node.

This is not true. To run a node, no ETH is needed. Anyone can easily sync their own self-verified Ethereum.

- The Merge will help in reducing gas fees.

False. There is no relation between the merge with network capacity so it will not get expanded. It is just a change of consensus.

- After the Merge, transactions will be faster

Though there will be some changes, still on layer 1, the transaction speed will remain the same.

- After the Merge, it will be possible to withdraw the staked ETH once

False. With The Merge, stake withdrawals are not yet possible. Staking withdrawals will be made possible by the next Shanghai upgrade.

- Validators won’t get any liquid Ethereum incentives until the Shanghai update, which enables withdrawals.

False. Fee tips and MEV will be credited to the validator’s mainnet account and made available right away.

- Stakeholders will all quit simultaneously when withdrawals are enabled.

False. Rate restrictions apply to validator exits for security purposes.

- After The Merge, Staking APR is anticipated to treble.

False More recent projections call for a rise in APR post-merger that is closer to 50% than 200%.

- The chain will experience downtime as a result of the Merge.

False. The Merge upgrade is meant to convert to proof-of-stake with zero downtime.

Plans for sharding are rapidly changing, but given the development and popularity of layer two technologies to scale transaction execution, the focus of sharding plans has shifted to determining the best method for distributing the burden of storing compressed call data from rollup contracts, enabling a rapid increase in network capacity. Without switching to proof-of-stake first, this would not be viable.

Therefore, this upcoming merge will strengthen the Ethereum foundation and prove to be a great step in the blockchain industry for smoother and easier transactions.

Additional Resources

Transfer ETH from Ethereum Mainnet to Polygon Mainnet