The smart contract space has been hugely dominated by Ethereum for the past decade. But with rising DeFi ventures and the launch of newer blockchains, that dominance has slowly started to fade.

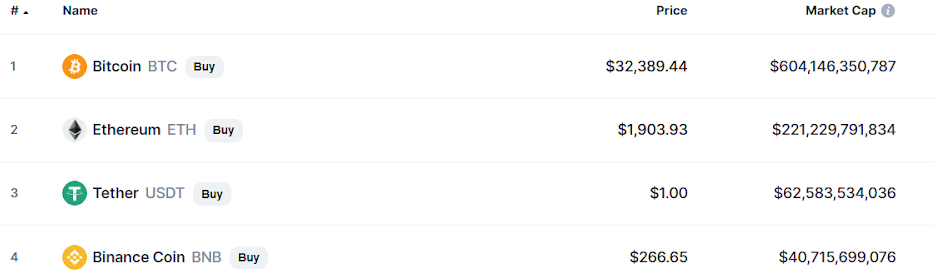

Binance Smart Chain is one such discovery that has been challenging Ethereum’s position in space. While Ethereum enjoys its day in the sun with ETH being the second-largest crypto asset, BSC doesn’t fall far with BNB in the fourth position.

Source: https://coinmarketcap.com/

Due to Ethereum’s high fees, Binance Smart Chain soared into popularity right after its launch. But is it worth it?

Let’s find out.

What makes BSC different from Ethereum?

Table of Contents

Binance has made colossal strides in catching up with Ethereum in terms of trading volume. The two also have very similar applications built on top of them like decentralized exchanges and lending and borrowing platforms. But they operate on two vastly different consensus mechanisms.

Ethereum currently uses a consensus mechanism known as Proof-of-Work (PoW), Binance Smart Chain, on the other hand, uses a mechanism called Proof-of-Authority (PoA).

Which one’s better?

PoW is fine when the network has great value, as it makes it worth the expensive computing needed to protect the network against a 51% attack. However, PoW does not work well when the network does not have a value, for instance, an Ethereum test network.

Let’s analyze both.

Recommend Read: List of most promising BSC projects

Advantages of PoA over PoW

As compared to Proof-of-Work which requires proof of spent computational resources, PoA consensus has several notable advantages:

- High-performance hardware is not required. Compared to a PoW consensus, a PoA consensus doesn’t need nodes to spend computational resources for solving complex mathematical tasks.

- The interval of time at which new blocks are generated is predictable. For PoW, this time is variable.

- High transaction rate. Blocks are generated at appointed time intervals, increasing the speed at which transactions are validated.

- Tolerance to compromised and malicious nodes, as long as 51% of nodes are not compromised.

Advantages of PoW over PoA

One of the biggest advantages of using a PoW is that it protects the network from a 51% attack. In this system, computers compete with one another to validate transactions. To win, the computer must solve complex mathematical puzzles.

Ethereum is, however, in the process of shifting to a new consensus model known as proof-of-stake (PoS) to reduce fees. In this, a consensus is reached by using an algorithm that chooses a node to win a block of transactions. When a node is chosen, it produces the next block of transactions in the chain.

Additional Resources: Recommended: What is BNB Faucet?

ETH vs BSC Statistics

*Data generated on Jun 23, 00:43 IST from https://etherscan.io/ & https://bscscan.com/

The Difference in Transaction Fees

The fee difference between the two networks is probably one of the biggest metrics that might be the reason ETH loses this battle! According to a survey,

- On BSC, users executed 5 million trades and spent only $456K in transaction fees.

- On Ethereum, users spend more than $207 million in transaction fees for 46 million trades.

Auditing Ethereum & BSC Smart Contracts

Smart contract platforms are still considered new and Ethereum occupies a major part of them. Most of the smart contracts we see today are developed on Ethereum. Hacks on either are inevitable. We saw Binance’s top projects.

Uranium Finance, Impossible Finance, and Pancake Bunny suffer huge losses. Similarly, projects on Ethereum have been exploited in the past as well, such as? the DAO hack.

Audits are key players in maintaining the security aspect of a project or application on any network. The number of unaudited decentralized projects that are floating in space is holding DeFi back and causing investors to either drop out or refrain from it all.

It doesn’t matter if a smart contract is developed on BSC or Ethereum, it must be audited. The two have different ways in which their applications can be exploited and only a thorough smart contract audit can help with that.?

Know more about Ethereum Audit and BSC Audit

Why is DeFi on Binance Smart Chain enjoying meteoric growth?

The BSC network’s growth is proven by seeing more and more migrated apps and users, who don’t want to pay the enormous gas fees charged on Ethereum. These are some of the top reasons why BSC is booming.

- Compatibility with EVM

- Interoperable Blockchain

- Low Gas fees

- Faster transactions

- Familiar tools and interfaces

Some of the popular projects that have decided to move from Ethereum to BSC are:

- IDEX

- C.R.E.A.M Finance

- Sushiswap

- Bounce Finance

There is room for multiple blockchains in crypto, but the first rumblings of discontent between Binance and Ethereum developers have already started.

Wrapping It Up

Needless to say, Binance Smart Chain is a faster and cheaper alternative to Ethereum. Along with that, it supports the easy porting of Ethereum dApps to BSC because of its EVM compatibility. However, the market is still quite hung up on Ethereum supremacy!

So, will Binance Smart Chain dethrone Ethereum?

We’ll just have to wait and find out. All we can say is that it surely seems promising.

About Us

ImmuneBytes is facilitating blockchain security by employing the use of cutting-edge techniques on smart contracts and decentralized applications.

We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.