It won’t be an exaggeration to say that Decentralized Finance (DeFi) has become an area where some of the most intriguing innovations occur frequently. DeFi has been booming since the summer of 2020; there has been no looking back!

Since Bitcoin began to catch on, myriads of alternatives have emerged. In the last few years, we have seen how popular DeFi tokens have become. Despite their outstanding yields and hype, they are often considered high-risk investments due to their high volatility.

If you are finding out the real-life use cases of DeFi tokens, then this blog will dedicatedly answer all the questions in your mind.

What are DeFi Tokens?

Table of Contents

- These are decentralized applications that run on blockchains with smart contracts.

- They transform banks, exchanges, and other traditional financial systems using cryptocurrencies.

- DeFi tokens reduce or eliminate the need to rely on a central authority or third-party intermediary.

- Most of the DeFi tokens run on the Ethereum blockchain.

- With the help of these tokens, users can easily trade, earn interest, get loans, etc.

- They are highly volatile yet give outstanding yields.

- Some of the most popular DeFi tokens include Uniswap (UNI), Chainlink (LINK), SushiSwap (SUSHI), Avalanche (AVAX), PancakeSwap (CAKE), Compound (COMP), Wrapped Bitcoin (WBTC), Dai (DAI).

What is the Difference Between a Coin and a Token?

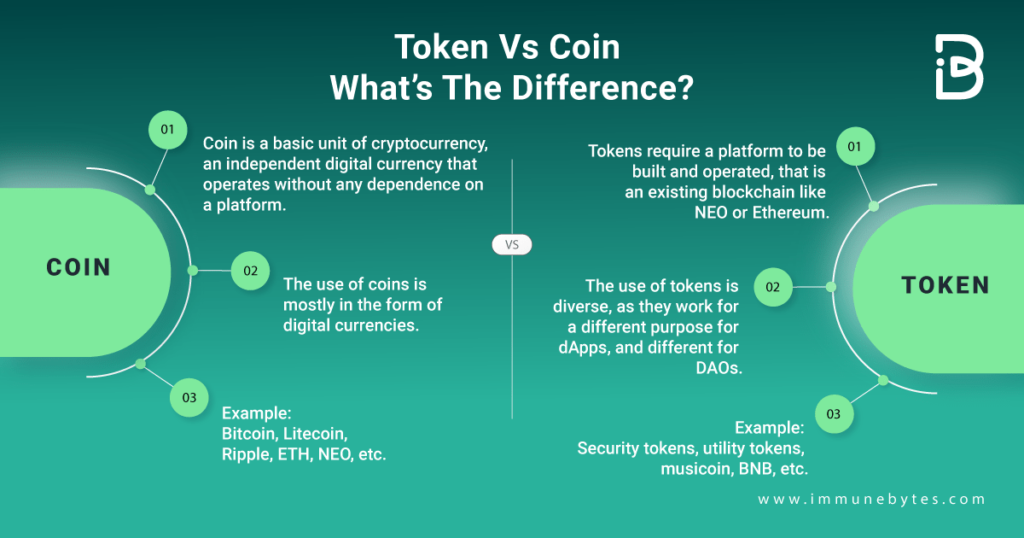

People often use the terms ‘coin’ and ‘token’ interchangeably. However, there are some differences between the two. The following infographic illustrates the major differences between Coins and Tokens.

Where Can You Buy DeFi Tokens From?

- Like any other user, you might think it is possible to buy these tokens only on DeFi protocols, but that’s not true.

- All the major DeFi tokens are listed on most of the Centralized Cryptocurrency Exchanges like Coinbase and Binance.

- You can easily trade or invest them just like any other cryptocurrency.

- You can also buy them from the DeFi composite index.

- Purchasing these tokens directly with a credit/debit card is possible.

- You can deposit Fiat and trade.

3 Real-Life Use Cases Of Defi Tokens

There is a different purpose behind every DeFi app for launching DeFi tokens. However, these are the most common use cases of DeFi tokens.

- Liquidity Pool Rewards

- DeFi tokens often serve as bait as an incentive to lure more users to their platform.

- Users who lock their crypto in the liquidity pool of a decentralized app get these tokens in the form of rewards.

- Since DeFi is ‘decentralized,’ it can easily take the benefit of the centralized banks to supply liquidity.

- Governance Tokens

- Several DeFi apps add the privilege of voting to their tokens to promote decentralized blockchain governance.

- This means that if you have these DeFi tokens, then in the future, you can have a say in the direction of a project.

- If crypto holders can vote and bring change with their DeFi tokens, these cryptos are technically governance tokens.

- For example- DAO, a DeFi protocol maker, issued a governance token known as MKR. Those users with this DeFi token get the privilege to vote on many aspects of the project.

- Additional DeFi services

- It is not like you can only interact with the DeFi apps if you have a DeFi token.

- As long as you have a wallet and native cryptocurrency of the blockchain, you will be allowed to use their services.

- However, there are situations where users get some additional features because of DeFi tokens.

- These include voting rights and crypto rewards for depositing their tokens in liquidity pools and staking them for extra benefits.

What Can You Do With DeFi Tokens?

These are the things that you can do with your DeFi tokens.

- Store/hold DeFi tokens

Most of the users hold on to their tokens with the hopes of increasing their value. So, you can use a reliable crypto wallet to store your DeFi tokens.

- Get to know more about these tokens.

You can read more in-depth articles about DeFi tokens to know how they work.

- Earn DeFi tokens

You can stake coins to maximize the holdings that would otherwise be stored in a wallet or trading account.

- Trade DeFi tokens

It is possible to trade more than 300+ tokens on different platforms. You can choose the platforms based on your needs.

Decentralized Finance (DeFi) is the future and is here to stay. It paves the way for Web3 users to access a new, reliable, decentralized financial system, unlike the traditional one. Despite being in the nascent stage, it has already done wonders for the blockchain community and has a lot on its plate for the future. To make this ecosystem safer, getting a DeFi audit is recommended.

Wrapping up

With DeFi tokens becoming popular daily, the list of real-life user cases is on a sharp rise. In this blog, we have tried to discuss the most popular ones, but that’s not the end. Hopefully, you’ve got all the answers to your questions.

If not, then you can always rely on professional experts who provide smart contract auditing services to help you eliminate vulnerabilities in your security code before a hacker finds them and turns them into expensive exploits.