One of the hottest topics of the DeFi summer of 2020 was yield farming and even in the year 2021, the total value locked in liquidity pools continues to reach new highs.

Every industry remains inescapable with the evolutionary process. With so much buzz around rising trends, the world is witnessing that the crypto space has reshaped every aspect to grow and build a better economy. While exploring to invest in specific cryptocurrencies and looking to churn out a significant profit, yield farming serves as the better option.

So what exactly is yield farming and how does it work? You’ll find all the answers in this blog, continue reading.

What is Yield Farming?

Table of Contents

- 1 What is Yield Farming?

- 2 Understanding Liquidity Pools, Liquidity Providers, and Automated Market Maker Model

- 3 How Does DeFi Yield Farming Work?

- 4 What Is APY in Yield Farming?

- 5 How are Yield Farming Returns Calculated?

- 6 The Risks of Yield Farming

- 7 Five Most Popular Yield Farming Protocols

- 8 The Future of Yield Farming

In simple words, yield farming is a way to make more crypto with your crypto.

Yield farming is the practice of staking or lending crypto assets to generate high returns or rewards in the form of additional cryptocurrency. In some sense, yield farming can be paralleled with staking. However, there’s a lot of complexity going on in the background. In many cases, it works with users called liquidity providers (LP) that add funds to liquidity pools.

Simply put, yield farming involves lending cryptocurrency via a blockchain network. In traditional finance, when loans are made via banks using fiat money, the amount lent out is paid back with interest. With yield farming, the concept is the same: a cryptocurrency that would otherwise be sitting in an exchange or a wallet is lent out via DeFi protocols (or locked into smart contracts) to get a return.

Understanding Liquidity Pools, Liquidity Providers, and Automated Market Maker Model

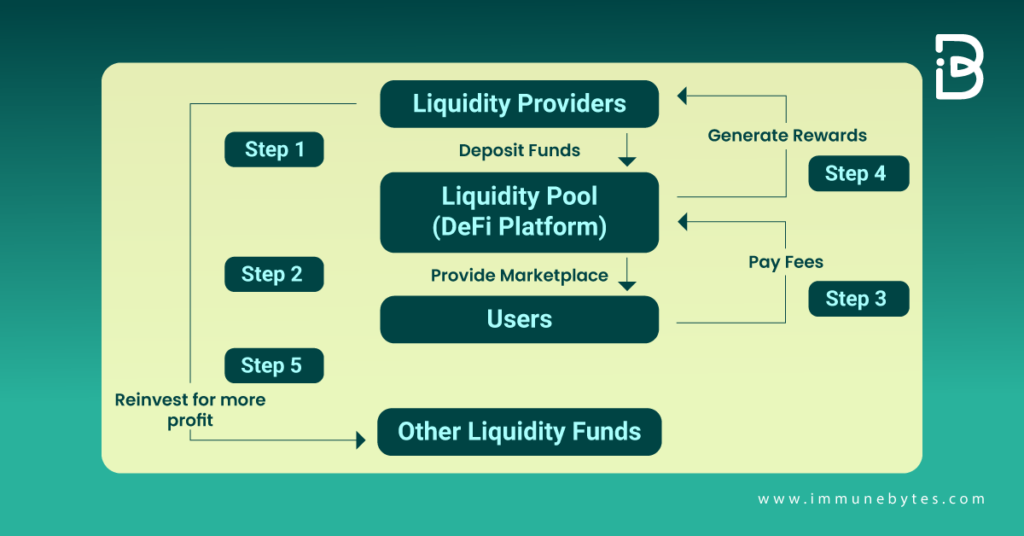

Yield farming works with a liquidity provider and a liquidity pool that powers a DeFi market.

A liquidity provider is an investor who deposits funds into a smart contract. The liquidity pool is a smart contract filled with cash. Yield farming functions based on the automated market maker (AMM) model.

Let’s understand these terms in more detail.

The AMM eliminates the conventional order book, which contains all “buy” and “sell” orders on a cryptocurrency exchange. Instead of stating the price that an asset is set to trade at, the AMM creates liquidity pools using smart contracts. These pools execute trades based on predetermined algorithms.

The AMM model relies heavily on liquidity providers (LPs), who deposit funds into liquidity pools. These pools are the bedrock of most DeFi marketplaces where users borrow, lend and swap tokens. DeFi users pay trading fees to the marketplace; the marketplace shares the fees with LPs based on their share of the pool’s liquidity.

Some of the most common DeFi-related stablecoins include USDT, DAI, USDC, and BUSD. Some protocols can also mint tokens, which represent your deposited coins in the system. For instance, if you deposit ETH into Compound Finance, you get cETH. If you deposit DAI, you get cDAI.

How Does DeFi Yield Farming Work?

As we discussed above, yield farming majorly involves the role of liquidity pools and liquidity providers. These pools exist on Automated Market-Maker (AMM).

For example, the platforms like Uniswap, Curve, and Balancer allow traders to swap tokens by depositing one token into the pool and getting a proportionate amount of the other in exchange. They pay a small fee to execute the transaction, which gets distributed into the entire liquidity pool. Liquidity providers earn this fee.

Here’s a detailed workflow of DeFi yield farming.

What Is APY in Yield Farming?

Yield farmers, and most protocols and platforms, calculate the estimated returns in terms of annual percentage yield (APY). It is a method of calculating the amount of money earned on a money market account over a year. To put it another way, this is a technique to track how interest accumulates over time.

The interest you earn on your funds is referred to as compounding interest. It refers to the amount received on both the principal amount (the money you put into the account) and the interest that has been accumulated.

How are Yield Farming Returns Calculated?

Typically, the estimated yield farming returns are calculated annually. This estimates the returns that you could expect over a year.

Some commonly used metrics are:

- Annual Percentage Rate (APR)

- Annual Percentage Yield (APY)

The difference between them is that APR doesn’t take into account the effect of compounding, while APY does. Compounding, in this case, means directly reinvesting profits to generate more returns. However, it should be noted that APR and APY may be used interchangeably.

Now that we’re well acquainted with the concept of yield farming. We should also look at some of the risks associated with it.

The Risks of Yield Farming

Yield farming isn’t simple. The most profitable yield farming strategies are highly complex and only recommended for advanced users. There are also considerable risks associated with it as well.

- One obvious risk of yield farming is smart contracts. Due to the nature of DeFi, many protocols are built and developed by small teams with limited budgets. This can increase the risk of smart contract bugs. Even in the case of bigger protocols, vulnerabilities and bugs are discovered all the time. Due to the immutable nature of blockchain, this can lead to the loss of user funds. Examples of vulnerabilities that resulted in severe financial losses include the Yam protocol, which raised over $400m in days before a critical bug was exposed, and Harvest. Finance, in October 2020 lost over $20 million in a liquidity hack.

- The DeFi ecosystem is heavily reliant on each of its building blocks. If just one of the building blocks doesn’t work as intended, the whole ecosystem may suffer. This is what poses one of the greatest risks to yield farmers and liquidity pools.

Five Most Popular Yield Farming Protocols

Yield farmers often use a variety of different DeFi platforms to optimize the returns on their staked funds. These platforms offer variations of incentivized lending and borrowing from liquidity pools.

Here are five of the most popular yield farming protocols:

- Compound is a money market for lending and borrowing assets, where algorithmically adjusted compound interest rate as well the governance token COMP can be earned. It is audited and reviewed to ensure the highest level of security standards. The total supply is over $10.14 billion as of Sept 2021 and APY ranges from 0.21% to 3%.

- Aave is an open-source non-custodial decentralized lending and borrowing protocol to create money markets, where users can borrow assets and earn compound interest for lending in the form of the AAVE token. The TVL in Aave is sitting at over $12 billion. Users can earn up to 15% APR for lending on AAVE.

- Uniswap is a hugely popular DEX and AMM that enables users to swap almost any ERC20 token pair without intermediaries.

- SushiSwap is a fork of Uniswap, which caused a huge wave in the community during its liquidity migration process. It is now a DeFi ecosystem, with multi-chain AMM, lending and leverage markets, onchain mini DApps, and a launchpad.

- Venus Protocol is an algorithmic-based money market system that aims to bring lending and credit-based systems to the Binance Smart Chain.

The Future of Yield Farming

It’s practically impossible to accurately predict the future in such a fast-paced, volatile space. Yield farming can attract more people to DeFi protocols and increase user adoption, despite still being an immature strategy.

It is yet to become an efficient market, meaning there are many opportunities to find a high return rate compared to traditional finance. That said, it is indeed a complex strategy, so while we have offered an overview here, you need to do your research and look at more detailed guides before venturing into the yield farming world.

About Us

ImmuneBytes is facilitating blockchain security by employing the use of cutting-edge techniques on smart contracts and decentralized applications. We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.