Cryptocurrency has had its fair share of expansion now. People are aware of it and it’s even widely traded. The crypto world has many options to pick and choose whatever cryptocurrency, exchange, or wallet fits their needs. But what about the times when crypto wasn’t as big?

One such company is Coinbase. Coinbase is the most popular consumer-facing crypto-asset exchange in the United States. Operating since 2011, the company allows users to buy, sell, and store crypto assets, like Bitcoin and Ethereum.

Maybe you’ve never heard of Coinbase. Or maybe you’re confused about what it even is. Here’s a detailed explanation of what Coinbase is, how it works, and how to get started with it!

An Introduction to Coinbase

Table of Contents

Coinbase is a secure online platform for buying, selling, transferring, and storing digital currency with a mission to create an open financial system for the world and help people convert digital currency into and out of their local currency.

Coinbase was the first major crypto business to go public in the U.S. when it began trading at $381 in April on the Nasdaq, giving the cryptocurrency exchange an initial market cap of $99.6 billion on a fully diluted basis!

It soared in popularity and turned itself into the on-ramp for mainstream crypto investors by positioning itself as a safe harbor among crypto-asset exchanges.

One thing that can be a selling point is that the company has never been hacked, unlike many of its competitors. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance.

What Does Coinbase Do?

Listed below are some of the main functions of Coinbase.

- Make buying and selling digital currency easy.

- Users can send or receive digital currency between online wallets, friends, or merchants on Coinbase, and that too for free!

- Handle security and backups so you don’t have to worry.

- A “one-stop-shop” – offers a wallet, an exchange, and merchant tools—all within one simple interface.

- Coinbase is a platform on which many applications are being built using their API.

However, while Coinbase is best known for its crypto-asset exchange, the company sure has bigger aspirations than helping people buy and sell crypto. The company’s stated goal echoes crypto-asset enthusiasts’ ultimate vision: to create a new “open financial system”.

Coinbase History

Coinbase was founded in July 2011 by former Airbnb engineer Brian Armstrong and was first funded by Y Combinator. In 2012, co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store Bitcoin.

Today, Coinbase operates in 32 countries and can be divided into four primary lines of business:

- Coinbase

- Coinbase Pro

- Coinbase Custody

- Coinbase Wallet

What Makes Coinbase a Crypto-Asset Kingmaker

Coinbase has emerged as something of a crypto-asset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation.

Where Bitcoin and other crypto-assets were once considered a “means of exchange” and an alternative payment system, they are now more often called a “store of value” and an investment opportunity.

Coinbase has overhauled its messaging and user experience to capitalize on this trend, with the company’s homepage now encouraging users to “buy and sell digital currency,” where it once welcomed users to “the future of money.”

Security

Exchanges have a long history of hacks, exit scams, and lost funds. The most well-known hacked exchange was Mt. Gox, which lost 850,000 Bitcoins to hackers in early 2014, worth $450M at the time.

Coinbase is the exception to this rule. Coinbase has continued to make security a top priority, and it’s paid off. The company has operated since 2012 and has never been hacked, establishing significant trust with consumers.

Regulatory Compliance

Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance.

The company has made a point of complying with state-by-state money transmission laws and is one of a few companies to hold a New York Virtual Currency License, or “BitLicense.”

Ease of Use

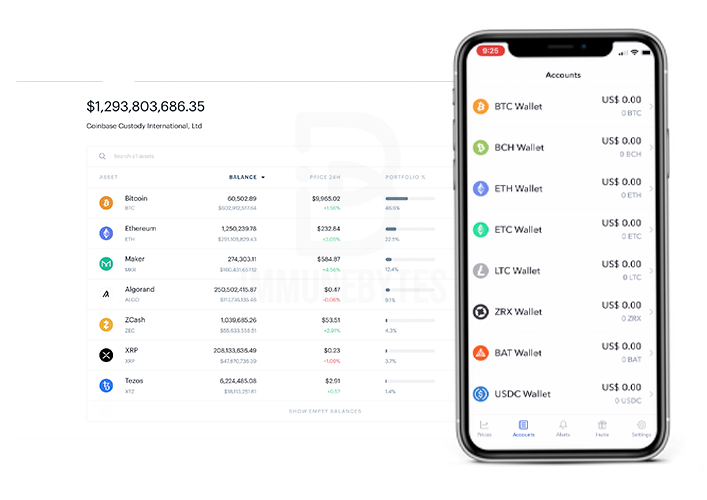

Adding to its security and regulatory compliance, Coinbase’s user interface and mobile application have helped the company position itself as the de-facto US crypto-asset brokerage.

In comparison to earlier iterations, Coinbase’s current user experience is simple, clean, and well-suited for crypto-asset retail investors.

Coinbase Growth Over the Years

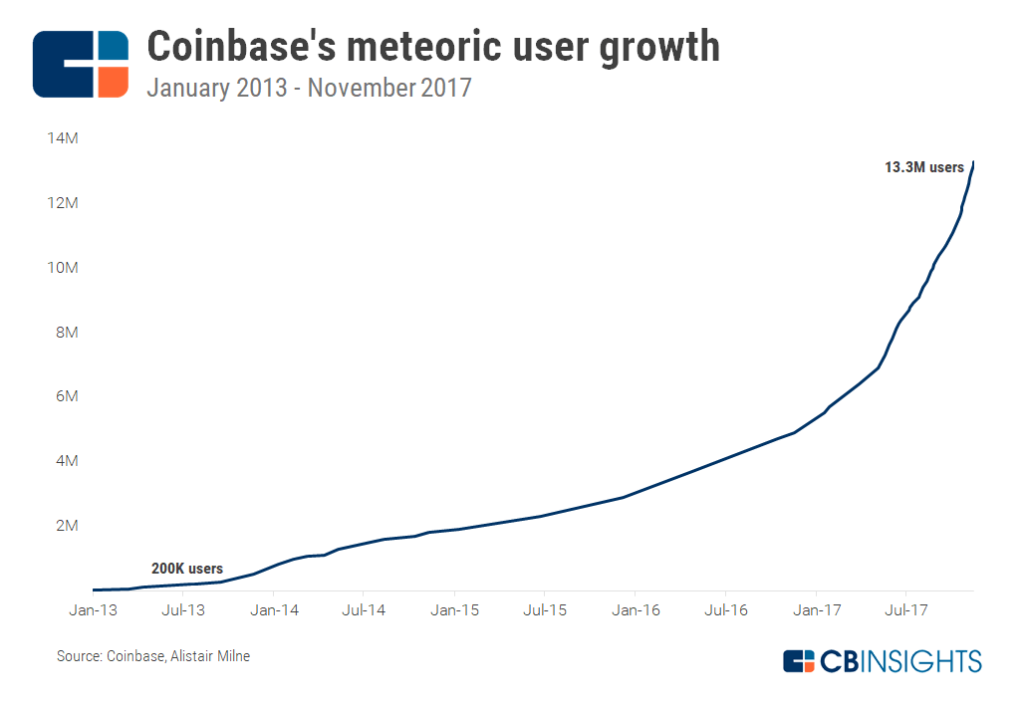

According to data aggregated by Alistair Milne of Altana Digital Currency Fund, Coinbase was adding users in November at a rate of 100,000 per day.

Although Coinbase has stopped publishing real-time user metrics, its site claims over 10M customers served and over $50B in crypto-assets exchanged.

Source: https://www.cbinsights.com/research/report/coinbase-strategy-teardown/#coinbase

Assuming an average 3% fee for Coinbase transactions and $50B exchanged, the total revenue of the company would be $1.5B. Of course, this number could be much higher or lower depending on the company’s true fees and total volume.

According to reports, Coinbase made $1B+ in revenue in 2017 alone. At the end of Q3 ’17, the company was projecting a 2017 total of just $600M, well under its actual.

Highlights

Here are some of the recent headlines Coinbase has made:

- Coinbase, the US’s largest cryptocurrency exchange, makes its Nasdaq debut.

April 2021 saw the introduction of Coinbase to the Nasdaq stock exchange. Analysts expect the company to be valued at $65bn to $100bn, making CEO and co-founder Brian Armstrong’s net worth up to $20bn. - Coinbase CFO says the firm has stockpiled billions to prepare for ‘crypto winter.

Since its public market debut in April, Coinbase has stockpiled around $4 billion in cash to prepare for a possible regulatory crackdown or so-called crypto winter, the firm’s chief financial officer told the Wall Street Journal. “We want to ensure that we maintain those cash reserves so that we can continue to invest and continue to grow our products and services in the event that we go into a crypto winter,” Alesia Haas said, referring to an extended drawdown in the market activity. Read more here. - Coinbase to invest 10% of quarterly net income into crypto.

Coinbase announced on August 20 that it had updated its investment policy, increasing its investments in crypto assets. Saying that it believes in a crypto economy “where buying, selling, spending and earning will be based on crypto assets,” the exchange hopes to encourage greater crypto utility eventually.

The Road Ahead

Coinbase’s user growth and revenue numbers imply a higher valuation than its most recent valuation of $1.57B. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain crypto-asset market by adding more crypto assets and exploring possible use cases for blockchain technology.

Coinbase continues to expand its core businesses and explore farther-ranging opportunities. It plans on adding more assets to its platform according to its “Digital Asset Framework.” Doing so would certainly pad the company’s pockets, but it would also allow a large user base to explore new use cases for blockchain technology.

The company understands its current and future position well and is actively working toward finding solutions that work while riding this market for as long as possible.

About Us

ImmuneBytes is facilitating blockchain security audit services, including reliable and extensive smart contract auditing, by employing the use of cutting-edge techniques.

We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far, we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.