Decentralization has proven its worth time and again yet its battle with traditional finance continues to linger on. Unlike innovations in other industries such as automobiles or technology, innovations in Finance are most often struck with skepticism.

DeFi brings to the plate what traditional finance could never even dream of. It calls for a new way of operating that can bring the promise of greater efficiency and access for consumers and businesses?beyond what we know at the moment. DeFi eliminates the distinction between ordinary customers and wealthy individuals or institutions, who have access to many more financial resources.

Today, the government and regulatory authorities hear the word DeFi and worry. However, given how skeptical the world was about past innovations that turned out to deliver major benefits, this isn’t terribly surprising. The upstanding question is, why does it need to be this way?

Can we instead conquer our brains? status quo bias and realize that DeFi might have the power to reduce the number of risks that exist in the traditional financial system?

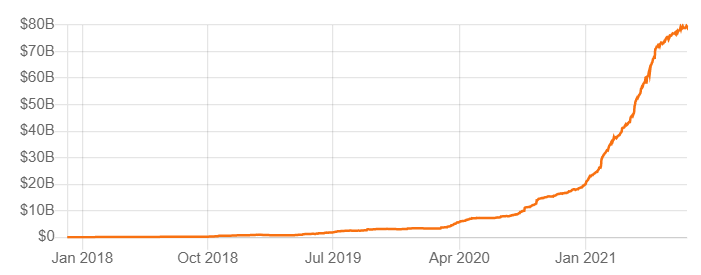

DeFi has grown this fast and become so significant for a reason. Every dollar that has been put into DeFi is one dollar that hasn’t been deposited into banks. In the roughly 18 months since the emergence of DeFi at scale, approximately $80 billion of capital has been contributed to DeFi protocols’something big.

Source: https://defipulse.com/usd

Why?

Because people decided that the risk-adjusted benefits of DeFi participation were more favorable than traditional banking or investment services. Traditional financial institutions have some undeniable shortcomings. Let’s take a look at what those are!

Shortcomings of Traditional Finance

For as long as any of us can remember, the rates that savers can earn at banks have been devalued due to various monetary policies such as post-financial-crisis quantitative easing and COVID-era stimulus programs.

This problem is aggravated by unchecked hidden fees that may reduce customer return even when explicit trading fees go to zero, the Robinhood effect.

On top of that, customers of one institution can’t trade with those of other institutions, for example, Venmo users cannot trade with Zelle users. This problem arises because of the inefficiency of ?walled gardens? created by centralized structures.

So then why can’t we all be on the same page and come to terms that DeFi is the first solid solution to all these withstanding challenges?

Additional Resource: Top 5 Use Cases of DeFi smart contracts

Is DeFi Foolproof?

Nothing can be made foolproof. There is always a risk factor associated with finance, be it centralized or decentralized. DeFi is not without risks.

- Money laundering can still happen under decentralized financial systems.

- An improperly programmed algorithm can still result in a disparate impact against creditworthy minority loan applicants.

- Many DeFi protocols are tightly integrated with their native token, whose value may be more volatile than other assets investors are accustomed to dealing with.

Despite all these risk factors, the fact remains that these technologies, when carefully and properly used, can help to solve many financial-system risks in one leap of technology, not just address them incrementally.

Recommend Read: DEFI’S NEWEST ECOSYSTEM, NEAR PROTOCOL

Final Thoughts

The growth of DeFi is inevitable, for the same reason that the displacement of libraries or post offices in America was the inevitable result of the original Internet. The transition from CeFi to DeFi has already started showing signs and the time is not far from when it will be complete. The need for great central repositories of information, commerce, and now finance is being reduced by technologies that allow decentralized peer-to-peer networks to perform the same functions more quickly and cheaply.

What we as consumers need to do is, believe that something as powerful as decentralization can solve the incompetencies of the traditional financial systems. Hopefully, we can recognize the behavioral psychology patterns that led some of us to fear earlier technology developments and almost led us to miss their benefits, as in the case of the Internet.

We are not to fear technology, we are to embrace it as it comes along, being fully aware of its pros and cons, and having a progressive mindset. It is merely the devil we know.

About Us

ImmuneBytes is facilitating blockchain security by employing the use of cutting-edge techniques on smart contracts and decentralized applications. We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.