In terms of price, the cryptocurrency markets have been rocked by a correction and most continue to trade within a range. Ethereum’s highly anticipated upgrade in the line could bring some good news for the market.

According to the lead developer, the much-awaited London upgrade for the Ethereum network will go live today on Aug 5 and we’re excited! It is Ethereum’s biggest update since the gas cost changes implemented in the Berlin hardfork in April.

This article will take you through everything you should know about this upgrade, the knick-knacks of EIP 1559, and what it means for the Ethereum miners? Let’s jump in!

What is EIP 1559?

Table of Contents

Ethereum is preparing for EIP-1559, the Ethereum Improvement Proposal.

EIP-1559 essentially focuses on changing Ethereum’s fee market mechanism. It is designed to make transaction fees less volatile and more predictable by altering the first-price auction fee mechanism to a new base fee model with an additional miner tip.

Must Read EIP-1559: ALL YOU NEED TO KNOW

What is Ethereum’s Fee Market Mechanism?

The mechanism currently employed by Ethereum works on first-price auctions where people bid a set amount of money to pay for their transaction to be processed, and the highest bidder wins.

Okay, but what is wrong with the first-price auction model?

The first price auction model is designed to prioritize high-value use cases and make sure that the blockchain isn’t filled with lower-value use cases. However, there is one single problem with the first-price auction mechanism, i.e., there is no way to calculate the optimal price of a single transaction.

Let’s say you included a Tx fee of $10 because the previous higher Tx fee was $8, but if everyone else is bidding $5, you would have been better off if you included a Tx fee of $6, saving $4 straightaway! This is why Ethereum needs a more predictable and stable mechanism.

But, will this make the gas cheaper?

Certainly not. EIP 1559 intends to make gas fees more predictable. It may happen that as a side effect of a more predictable base fee, EIP-1559 may lead to some reduction in gas prices if we assume that fee predictability means users will overpay for gas less frequently.

With EIP-1559, the base fee will increase and decrease by up to 12.5% after blocks are more than 50% full. Precisely,

- if a block is 100% full the base fee increases by 12.5%

- if it is 50% full the base fee will be the same

- if it is 0% full the base fee would decrease by 12.5%

- If the network congestion is higher, the base fee will be higher

- if the network congestion is lower, the base fee will be lower

These are the main factors that will affect the price of the gas fees on the network.

Moving on to EIP 1559’s working

How does EIP 1559 Work?

We saw what was wrong with Ethereum’s fee model. Now, let’s see how does this upgrade works to make it more stable and predictable for users.

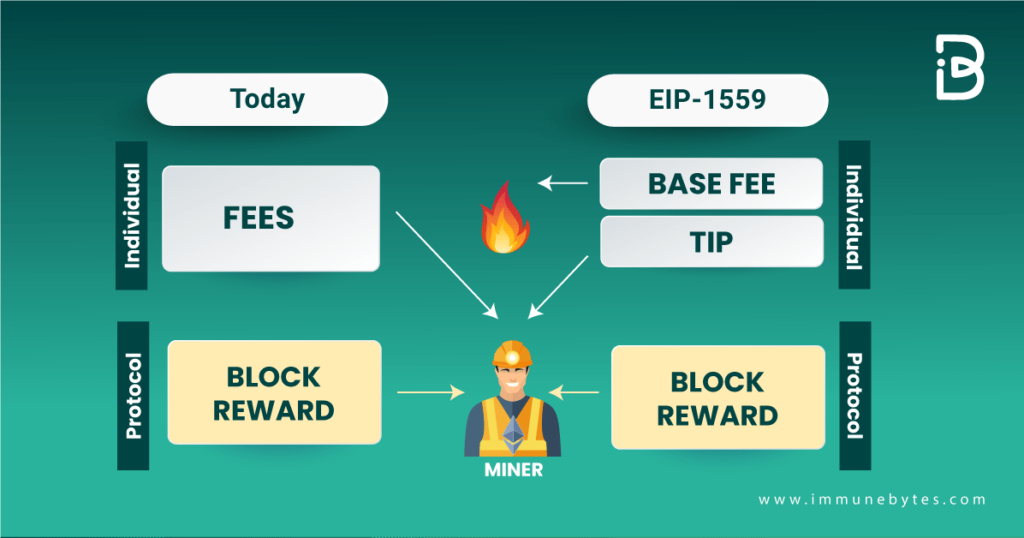

EIP- 1559 introduces two new types of fees: base fee and priority fee.

A discrete ?base fee? for transactions to be included in the next block has to be paid. And for users or applications that want to prioritize their transaction, they can add a ?tip,? which is called a ?priority fee? to pay a miner for faster inclusion.

In the current model, fees are paid to miners, who also receive the block reward of 2 ETH per block, plus uncle rewards. With EIP-1559, the base fee is burned, but a tip and the block reward still go to the miner.

How does this help users?

The idea is to make fees based on block demand more transparent for the user. Crypto Wallets like MetaMask will be able to have better fee estimates, and won’t have to rely much on external oracles since the base fee is managed by the protocol itself.

Why are the Miners Unhappy?

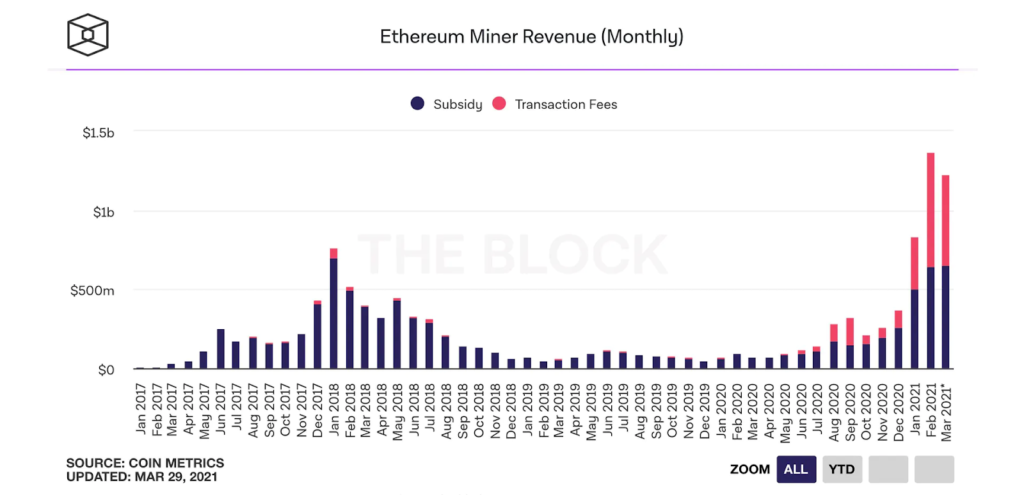

Last month, Ethereum miners made a whopping $1.3 billion, and almost 50% of it came from transaction fees.

Thus, this new proposal comes as bad news for them!

There is an inclusion fee that will directly go to the miners but people can opt not to add it, alongside the base fee.

Ethereum’s improvement proposal has been experiencing resistance from some mining pools. Flexpool launched a marketing campaign against the EIP in early 2021, which was joined by several other pools.

More than 50% of Ethereum’s current total hash rate is opposed to the movement; this represents a bit of a conundrum for Ethereum. It’s unclear how that might impact the rollout of the proposal, but some miners have already sought alternative revenue streams, most notably, miner extracted value.

Regardless, EIP-1559 gives miners more control over the block size and makes their revenue more predictable!

Will this Make ETH Deflationary an Asset?

In addition to introducing the base fee, it will also be ?burned? after the implementation of the EIP 1559 upgrade. Very likely, this will lead to a deflationary Ether token economy.

While proposal EIP-1559 helps to reduce transaction costs, its design has also been dubbed ?Ethereum’s scarcity engine?. This is happening because the base transaction fee, instead of going to a miner, will now be effectively sent to the network and ?burnt? reducing the amount of supply.

?Ethereum’s net annual issuance will drop substantially following the Phase 1.5 ETH 1 to ETH 2 merger,? said Messari research analyst Wilson Withum.

Much like Bitcoin’s halving events, a reduction in issuance of new Ether could create pressure on supply as the amount of new Eth entering circulation is constrained.

But not everyone is happy!

Conclusion

The revolt from miners is not going to stop Ethereum from rolling out this upgrade. EIP 1559 has a financial incentive up its sleeve.

Overall, this upgrade looks promising and could have a major impact on the Ethereum ecosystem, however, the changes may be slow rather than occurring at the time of the change. With the migration to a proof-of-stake network still, some way away, expect a bumpy summer for Ethereum and its price, once EIP-1559 goes live.

About Us

ImmuneBytes is facilitating blockchain security by employing the use of cutting-edge techniques on smart contracts and decentralized applications. We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.