Once deemed unhackable, blockchain is now getting hacked. About 34,200 current Ethereum smart contracts worth $4.4 million in the ether are vulnerable to hacks due to poor coding practices, as reported.

One of the biggest reasons why smart contracts are prone to such attacks is the absence of third-party audits. Audits involve a high investigation of smart contract code to find any vulnerability, fix it, and secure any other flaws before it is publicly deployed.

Harvest Finance was recently hacked for a ~$34 million flash loan attack. The team is sorry for the ?engineering error? which caused the FARM to plummet from $242 to $100. Read an in-depth report here. Attacks like these not only affect the organization but also impede the trust of its stakeholders, i.e. its investors and contributors.

Why is Smart Contract Audit so Important?

Table of Contents

Most smart contracts are developed by multiple developers which unnecessarily leads to high levels of complexity, resulting in higher risks of various intensity and increasing the attack surface of Dapp.

Auditing ensures:

- Code optimization

- Enhanced smart contract performance

- Security against hacks

Auditing is important for companies who want to attract a large number of investors, contributors to pool money for their contract and want to be reassured that their smart contracts are impenetrable and safe against attacks.

Recommend Read: What is a Smart Contract Security Audit

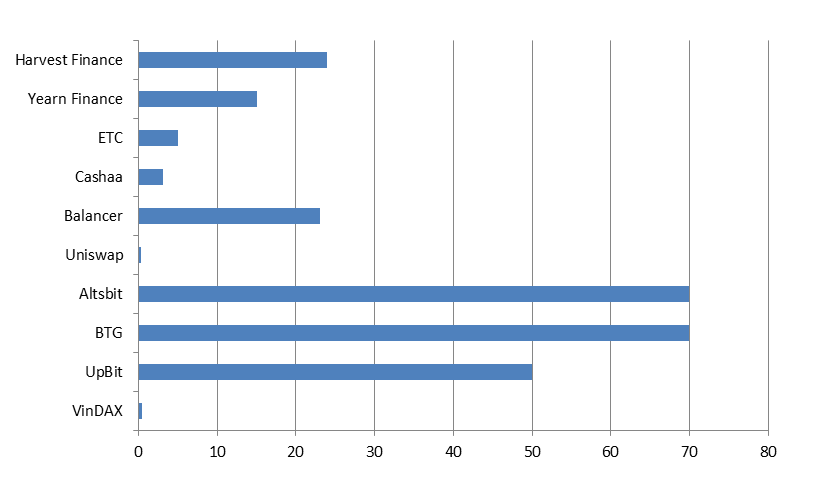

Top hacks dated from Oct 2019 – Oct 2020 with value lost in Million

What’s the Need for Smart Contract Insurance?

Smart contracts will dominate the finance industry and have a major inference for our growing data economy, making transactions more efficient, transparent, and secure. As we move forward, it’s important to be well aware of the inevitable risks associated with smart contracts and learn how we can better mitigate them.

Here comes the need to get your smart contracts insured, be covered for incidents like the DAO hack or the ?economic attack? on Harvest Finance. The different types of insurance include:

P2P Risk Sharing Platform- A group of organizations/insureds forms a shared risk pool through which particular types of risks are underwritten, with premiums, losses, and expenses shared in agreed ratios. Those with skills can assess the risk associated with a particular smart contract and can then stake value against the ones they think are well-coded and secure.

- Solo- A single organization/insured bears the premium and in turn is responsible for the profitability or loss incurred by a particular smart contract.

Some Assumptions for Premium Calculation of Smart Contract Insurance

There are several factors that are considered while estimating insurance for a smart contract:

- Risks associated with the Smart Contract-

- If the smart contract to be insured is audited beforehand, the user has to pay considerably less premium as it has gone under a scrutiny check and all/most of the issues might have already been resolved.

- If not, the user has to pay more as the risk associated with it is higher.

- Audit report Refactor

- The value locked in the smart contract-

- Evidently, a smart contract holding a higher value will amount to a higher premium.

- Whereas, the one with lesser value locked will amount to a considerably less premium.

- Test cases and Coverage report-

If the developers provide the test cases against which the smart contract has been tested and the coverage report of the smart contract, implying that all the given scenarios are investigated, consequently the premium to be paid will be less.

- Type and Complexity-

Different types of smart contracts have different structures and coding complexities. Some of the major types include- Smart Legal Contracts, DAOs, and Application Logic Contracts. The level of complexity is then identified by professionals and the premium is calculated accordingly.

Currently, there aren’t any legal frameworks that support a full-on smart contract-enabled society but eyeing their growth, one can say that in the near future smart contracts are going to be vital in the finance industry. So, why not stay ahead of time? If you’re endeavoring to start a blockchain-based business or are already established, don’t risk losing your money. Get your smart contracts audited and insured today.

To get an audit for your smart contract, connect with the professionals at ImmuneBytes today, and stay a few steps ahead in protecting your smart contract.