Cryptocurrency holders worldwide are in a panic as the cryptocurrency market saw a big correction with prices of major currencies last week, including Bitcoin, Ethereum, BNB, and others crashing as much as 30% within 24 hours.

Bitcoin, the world’s largest cryptocurrency, tanked by close to 40% from its record high levels to the US $31,000 on Wednesday, a level last seen this year, in February. A week before the fall, it was trading above $55,000. The other two popular cryptocurrencies ? Dogecoin and Ethereum have also fallen by 45% and 40%, respectively.

At the time of writing, the total crypto market volume over the last 24 hours is $130.85B, which makes an 11.42% decrease.

In this blog, we will explore the possible reasons that might have contributed to this price fall.

What exactly Went Down?

The magnitude of perceived losses in this recent crypto crash eclipsed all previous capitulation events, including March 2020, November 2018, and the sell-off that ended the last bull market in January-February 2018. An on-chain report published by Glassnode conveyed that a new all-time high of $4.53 billion in losses was booked on 19 May and $14.2 billion for the week.

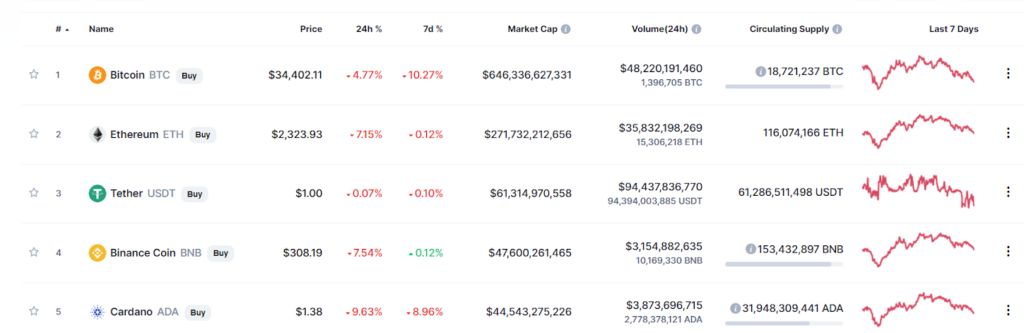

Source: https://coinmarketcap.com/

The Bitcoin market has experienced tremendous deleveraging, with prices falling nearly 50%, and on-chain entities taking historical losses. During the week, the world’s biggest cryptocurrency traded down by over 47% from the weekly high of $59,463 to lows of $31,327.

Listed below are some of the other significant cryptocurrencies that tanked the past week.

- Ethereum is down 11%, from a 24-hour high of $2860 to a low of $2479.

- Dogecoin is down 7.8%, down from a 24-hour high of $0.34 to a low of $0.31.

- Matic, which has shown immense returns in the past few weeks is down 16%, from a high of $2.25 to $1.8.

- Binance Coin (BNB) is down 12%, from a high of $387 down to $325.

- Litecoin is down 6%, from a high of $208 to a low of $182.

- Chainlink is down 16%, from a high of $35 to a low of $28.5.

- Uniswap is down 7%, from a high of $29.9 to a low of $25.

- Cardano is down 12%, from a high of $1.7 to a low of $1.51.

Most other major coins also felt the effects of this fall, except for PUSH, up by 8%, and Helium (HNT), up by 4%.

Recommend Read: Volatility Trading

What are the Possible Reasons Behind It?

To be upfront, experts blame Tesla CEO Elon Musk’s tweets and China’s recent action on the crypto front for the great fall.

On Tuesday, China banned financial institutions including banks and payment companies from providing services related to cryptocurrency transactions and warned investors against speculative crypto trading.

One Twitter account every crypto holder follows is Tesla CEO’s. When Tesla announced earlier this year that it would start accepting Bitcoin, crypto supporters were excited that this may mean other companies would follow suit.

However, not soon after, Elon Musk announced that the electric carmaker won’t be accepting Bitcoin as payment? a reversal of an earlier decision.

?Realistically, it is not the first time Elon Musk’s tweets have been erratic and, frankly, wrong,? said Ulrik Lykke, executive director at crypto hedge fund ARK36. ?The crypto markets are extremely emotionally driven and their participants are prone to overreacting to events they perceive as negative.?

And so, the Musk Effect lingers on.

What’s Next?

?Despite this being a historical capitulation event, relative to the market size, the value of underwater positions on-chain is relatively small. We can compare this to relative unrealized losses of 44% in March 2020 and over 114% in November 2018,? reported Glassnode.

The report also highlighted the fact that a large portion of the recent selling activity was driven by short-term holders, those owning coins purchased within the last 6 months. Moreover, during this sell-off, the selling of one- to three-year-old coins was significantly less, suggesting that old hands did not panic sell nor rush for the exits.

Those in the ecosystem have termed this decline as a short-term correction. Bitcoin and Ethereum have taken tumbles, much worse than the current downturn. Long-term investors are seeing this incident as a buying opportunity.

To summarize, the fall does look dramatic but for a volatile market, it’s not an unusual one, especially after such a massive rally.

About Us

ImmuneBytes is facilitating blockchain security by employing the use of cutting-edge techniques on smart contracts and decentralized applications. We have a team of experienced security professionals who are adept at their niches and provide innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.