Are you a EuroCurrency enthusiast looking for the most profitable strategy for your financial future?

Do you find it difficult to decide which currency is right for you? Or do you just want to know which currency is the most popular and how much it costs?

If you answered “yes” to any of these questions, then this article is for you!

In an ever-changing world, a stable currency can be a precious resource. With the constantly fluctuating value of the dollar, one great way to keep your spending power steady is by using a stable cryptocurrency such as Bitcoin or Ethereum.

What are Stablecoins?

Table of Contents

- 1 What are Stablecoins?

- 2 Why did Stablecoins Grow So Much in 2022?

- 3 What Is EuroCurrency?

- 4 What Is USDC Currency?

- 5 What Is USDT Currency?

- 6 EuroC vs Usdc vs Usdt : What’s More Stable

- 7 Is USDC and USDT Stable?

- 8 Is EuroC Stable and USDT Stable?

- 9 Is USDC and EuroC Stable?

- 10 What Are the Future Aspects of EuroC vs Usdc vs Usdt?

- 11 Conclusion

A stablecoin is valued 1:1 against an existing currency such as the US dollar, euro, yuan, or gold, keeping its value steady against that of the asset.

The fact that people are turning to cryptocurrency to make payments is the reason for the popularity of USDC, USDT, and other stablecoins. The former alternatives are on the blockchain, whereas these are not.

In 2010, Laszlo Hanyecz bought two pizzas with 10,000 Bitcoin (worth $30 at the time) which is thought to be the first instance of blockchain payment. Today’s value of Bitcoin is $350 million.

Although Bitcoin is the most widely used cryptocurrency for payments, it is difficult to use and accept due to its high volatility.

With stablecoins, blockchain payments are available to institutions, traders, and individuals without the volatility or complicated tax computations of Bitcoin or ether. They allow institutions, traders, and individuals to hold crypto without dealing with the highs and lows of Bitcoin or ether.

The stablecoin issuer holds a reserve in a bank for the asset that backs the stablecoin. Then, this reserve serves as collateral for the stablecoin. This is similar to how both USDT, USDC, and similar assets collateralize their stablecoins with fiat.

Why did Stablecoins Grow So Much in 2022?

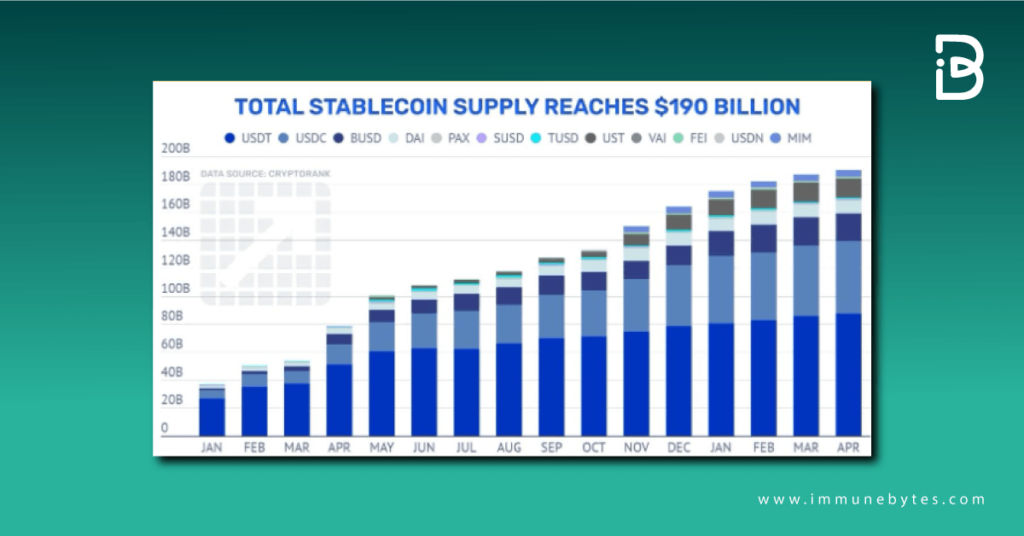

Stablecoins rose by 4x in 2022, accounting for almost half of the total stablecoin supply increase. In February 2022, they were at $180 billion, 1.5 times more than in February 2021.

Stablecoins, which make advanced tools built on top of blockchain technology accessible and usable to developers and traders alike, are key to the increased growth of DeFi in the summer of 2020.

Stablecoins are used by companies across the world to speed up cross-border payments by using them in conjunction with DeFi. Stability is becoming more and more important as a result of the trend.

Companies are increasingly turning to global reserve currencies for payments. Many companies prefer to use a currency that is pegged to global reserve currencies.

Now let’s explore the stablecoins in crypto: EuroCurrency, USDC, and USDT.

What Is EuroCurrency?

The Euro is the currency and monetary unit of the European Union, symbolized by the ? sign. The euro was first launched as a noncash monetary unit in 1999, and currency coins and notes were released in 2002.

The Euro replaced the currencies of EU members as well as certain non-EU countries. The Euro is used by more than 340 million Europeans and is the second most widely held international currency after the U.S. dollar.

The Euro is a global reserve currency, used by several countries’ central banks, and is the world’s second-most traded currency.

What Is USDC Currency?

USDC (USDC) is a tokenized US dollar, with one USDC coin equal to one USDC coin. It is backed by US dollars. The value of one USDC coin is linked 1:1 to the value of one US dollar, making it a stablecoin.

This is achieved by holding one or more U.S. dollar reserves in accounts that are legally and commercially distinct from the Gemini exchange, in order to provide a stable store of value for USDC.

All USDC tokens are fully collateralized by U.S. dollar assets held at multiple FDIC-insured banks located in the United States.

The USDC tokens are issued by the company known as CENTER, which is also responsible for maintaining the 1:1 peg to the U.S. dollar, and will provide regular audits of all underlying assets to prove that they have sufficient dollar reserves on deposit to support the USDC stablecoin.

What Is USDT Currency?

Tether (USDT) is a cryptocurrency stablecoin pegged to the U.S. dollar and backed “100% by Tether’s reserves,” according to its website. Tether is owned by iFinex, the Hong Kong-registered company that also owns the crypto exchange BitFinex.

The idea behind Tether is to create a cryptocurrency that is stable enough to be used as a proxy for the U.S. dollar and other fiat currencies, which can help stabilize prices on cryptocurrency exchanges.

BitFinex users can redeem their Tether tokens for U.S. dollars, and the company plans to introduce other fiat currency?backed tokens soon.

Tether is controversial because of questions about how it’s backed by actual dollars and whether it might be used to manipulate prices in the crypto market since its creators have never been transparent about how they hold dollars to guarantee the value of Tether in relation to the dollar or whether they hold an equivalent amount of USDT in reserve at all times.

The company has also been opaque about its process for withdrawing and adding new tokens from circulation and what information it provides users who inquire about individual transactions

EuroC vs Usdc vs Usdt : What’s More Stable

The main advantage of EuroCurrency over usdc currency is its stability. The reason why EuroCurrency is more stable than usdc currency is because of its much larger geographic area.

With the implementation of EuroCurrency, the risk of financial crises in specific countries like Greece, Italy, and Spain would be minimized. In the same way, the uncertainty of the global financial situation would be reduced as there would be a single currency for all of Europe.

However, there is a downside to this too. With the reduction in the number of countries that use EuroCurrency, political and military conflicts would also be less likely. Therefore, there would be less diversity in the world economy and less of a chance for new technologies and ideas to spread to all parts of the globe.

Is USDC and USDT Stable?

When it comes to the stability of the United States dollar, there is no question about it. It is the de-facto standard for international trade and is the reserve currency for most of the world.

Among the many reasons why the dollar is considered to be stable is because it has been pegged to the German mark (DE) since 1971. In fact, the dollar is so tied to the mark that when the mark hit a record low in 1999, the United States Federal Reserve Bank put in a floor drop of 1% to protect the value of the dollar.

Is EuroC Stable and USDT Stable?

Unfortunately, that’s not the case for either of these two cryptocurrencies. While the dollar is generally viewed as being more reliable than the euro, that’s not the case for all coins.

For example, the EUC is a completely new coin with no history to speak of and has only been in development since 2011. Even then, the developers had little to go on other than the idea of a decentralized digital currency. So the fact that it has managed to stay relatively stable is a credit to its designers.

Is USDC and EuroC Stable?

Both USD and EUR are considered to be stable currencies because they never experienced significant price volatility against each other. Both currencies have also remained relatively stable over time, which means they can be used to store wealth, exchange payments, and hold financial assets.

What Are the Future Aspects of EuroC vs Usdc vs Usdt?

The future aspects of EuroCurrency, just like the main aspects of the above-mentioned currencies, are very similar to those of USDC/USDT Currency. Both currencies are meant to compete with the USD and are extremely similar in structure.

The only major difference is that while usdc Currency is a fiat currency, EuroCurrency is a freely convertible currency. Both European Central Banks and the European Union have made it clear that they want to create a common currency.

According to their logic, the only logical thing to do would be to first create a common currency between them. The aim is to create a currency that would work across national boundaries and with no restrictions on the amount of money that can be used in one country compared to another.

Conclusion

Stability is one of the most important aspects of any investment strategy. Cryptocurrencies that have almost no chance of changing in the next month or two are not as attractive as those that can potentially change very quickly.

So, how can you protect yourself from potentially volatile cryptocurrencies?

Well, the best part is that it doesn’t matter which type of cryptocurrency you want to hold, as long as you’re happy with the investment strategy and don’t expect too much from your investments, you can bet on anything.

About ImmuneBytes

We at ImmuneBytes offer enterprises and startups comprehensive smart contract auditing solutions for their applications to have a secure commencement. Our journey begins with an aim to foster security in the upcoming blockchain world, improving the performance of large-scale systems.

ImmuneBytes administers stern smart contract audits, employing static and dynamic analysis and examining a contract’s code and gas optimization, leaving no escape route for bugs.