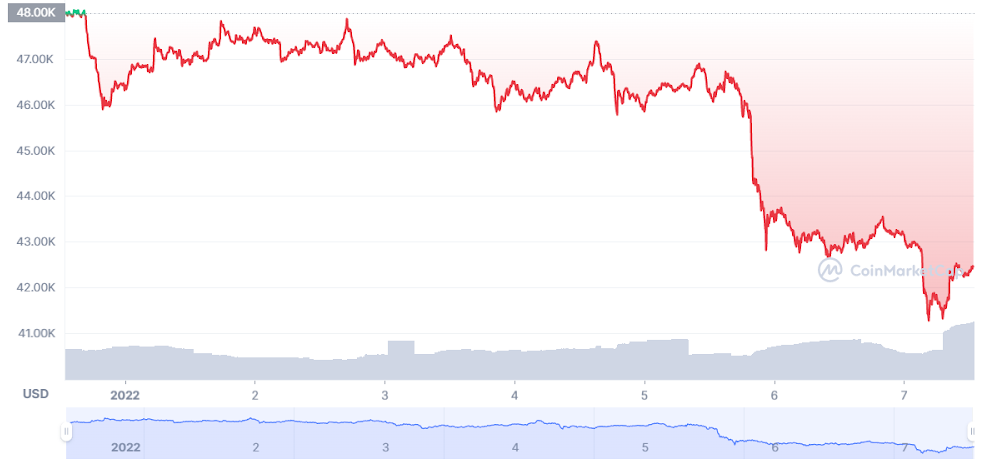

After a tumultuous end for the cryptocurrency market in 2021, Bitcoin’s price plummeted again in early January in a flash crypto crash.

While Bitcoin’s price was trading at around $50,000 just over a month ago, cryptocurrency prices crashed on Wednesday evening. It then continued to tumble on Thursday, falling as much as 8% in morning trading. Other cryptocurrencies were falling even more as investors pulled back on the sector.

The world’s largest cryptocurrency had been trading at around $42,900, currently down 0.95% from its 24-hour high, according to CoinMarketCap, though trading remains volatile.

It’s trading at its lowest since October, aside from a flash crash in December, and it’s well below the $46,000 price shortly before the Federal Reserve’s December minutes were released.

Ether, the second-largest cryptocurrency, was 11% lower at $3,252. Other major cryptos were down sharply, including Solana, off 11.3% to $141, Cardano, down 9.01% to $1.23, and Binance Coin, sliding 12.53% to $455.

Alt-tokens typically outperform Bitcoin in bull markets and underperform in a selloff, a trend that appears intact in the latest bout of weakness.

Here are some of the possible reasons for this bloodbath. Let’s take a look!

Political Turmoil in Kazakhstan

Table of Contents

Political turmoil in Kazakhstan is hitting the country’s vast bitcoin mining industry. The country accounted for more than 18% of the global Bitcoin network hash rate last August.

The Central Asian nation plunged into chaos as violent protests sparked by rising fuel prices left dozens killed and hundreds injured.

As part of the mayhem, the Internet and telecommunications cuts have been reported nationwide. And that’s impacting local cryptocurrency mining operations, which are among the largest in the world. The hash rate has plunged 12% since then.

The protests in Kazakhstan began over a spike in fuel prices. But there are also other long-standing issues behind the public fury, such as income inequality and economic hardship, which have all been exacerbated during the coronavirus pandemic, according to Human Rights Watch.

Kazakhstan emerged as a popular mining hub last year after neighboring China cracked down on the activity. It is home to coal mines that provide a cheap and abundant supply of energy, a major incentive to miners who compete in a low-margin industry, where their only variable cost is typically energy.

It is still unclear when internet services will be restored in Kazakhstan, making it hard to know how deeply crypto miners will feel the impact. According to internet monitor Netblocks, connectivity had been shut for 36 hours as of Friday morning.

US Nasdaq Stock Index

The US stock market has not been performing well in the past week. This has always been a direct influencer of the crypto market, as can be seen in this market crash.

The Fed minutes spooked the markets, raising the possibility of a rate increase as soon as March and a potential reduction of the central bank’s $9 trillion balance sheet.

Cryptos now appear to be moving in tandem with the technology-heavy Nasdaq Composite, which slumped 3.3% on Wednesday as investors ditched the riskiest tech stocks for safer assets.

The New COVID-19 Strain

The recent announcement of the latest COVID-19 strain appears to be an underlying factor in the market’s recent bearish sentiment.

2020 saw a huge drop in the market when the world was hit with the COVID-19 pandemic, and the same trend can be observed in the market now as well.

What Does This Price Drop Mean for Crypto Investors?

The one thing that is constant with crypto is change!

For those who invest in crypto for the long term using a buy-and-hold strategy, swings like this are to be expected. Big dips are nothing to be overly worried about.

Experts recommend keeping your cryptocurrency investments under 5% of your portfolio. If you’ve done that, then don’t stress about the swings because they’re going to keep happening!

If this type of extreme drop bothers you, you may have too much riding on your crypto investments. And as it is popularly said in the community, you should only invest what you’re okay with losing!

About Us

ImmuneBytes is a Blockchain security firm that employs the industry’s best tools and practices to provide a comprehensive smart contract audit.

We have a team of robust and experienced security professionals who are adept at their niches and provide you with quality service. We have worked on 175+ projects spread across the world on different Blockchain frameworks with some of the industry’s top firms, and we continue to unfold the decentralized movement.

We are also providing consultancy, coming up with a bug bounty platform, and an insurance product to provide our clients with a hassle-free security product catalog. Stay tuned.