Undoubtedly, Bitcoin mining is a hot topic in the cryptocurrency space, essentially the core of it. In recent news, it has been observed that prices for Bitcoin mining machines have been trending upward. A combination of factors is responsible for more expensive ASICs, components that are at the heart of the specialized machines used to secure the Bitcoin network in exchange for BTC rewards.

This could possibly be an aftereffect of strained supplies, congested global shipping lanes, growing demand from Chinese miners moving outside of China, and the skyrocketing demand and interest in Bitcoin.

What does this price surge mean for Bitcoin and how will it affect the future? Let’s take a look at it and discuss in detail what is causing this price increase!

Why the surge in prices?

Table of Contents

As mentioned before, the price surge could be a result of a couple of factors. One of the biggest ones being miners hoarding ASICs.

Chinese miners are affecting the market value of mining machines by withholding a large number of machines from the market. Due to China’s recent mining crackdown, these miners are unable to use their ASICs.

The miners that haven’t been able to relocate are choosing to simply sit on their machines instead of selling them, risking flooding the market, and resulting in a loss. In short, hoarders are hoping that the prices for Bitcoin and ASICs continue to appreciate, giving them the ability to slowly sell their machines for a profit or find available hosting space for relocation.

Another factor is COVID-19. Apparently, CVOID- 19 also played a major role, as Whatsminer factories in Thailand and Malaysia were almost forced to close in August 2021 due to the spread of the virus.

Thirdly, the chips are low. The supply is strained and the demand is high! Computer chips are by far the most expensive component of an ASIC platform and orders are being held up due to a global shortage of many industrial products including microprocessors, telephones, automobiles, and other electronic devices.

Samsung and Taiwan Semiconductor Manufacturing Company (TSCM), two of the biggest makers of these chips, recently raised prices to meet growing demand.

ASICs used for Bitcoin mining account for less than 1% of Samsung and TSCM’s sales, and chip buyers like Apple and automakers are ahead, Zhang said. There is no doubt that Bitcoin miners are getting “second-level processing” from Samsung and TSCM.

Another impactful reason is the rising price of Bitcoin. Let’s see how!

Rising Bitcoin Price, Rising ASIC Price

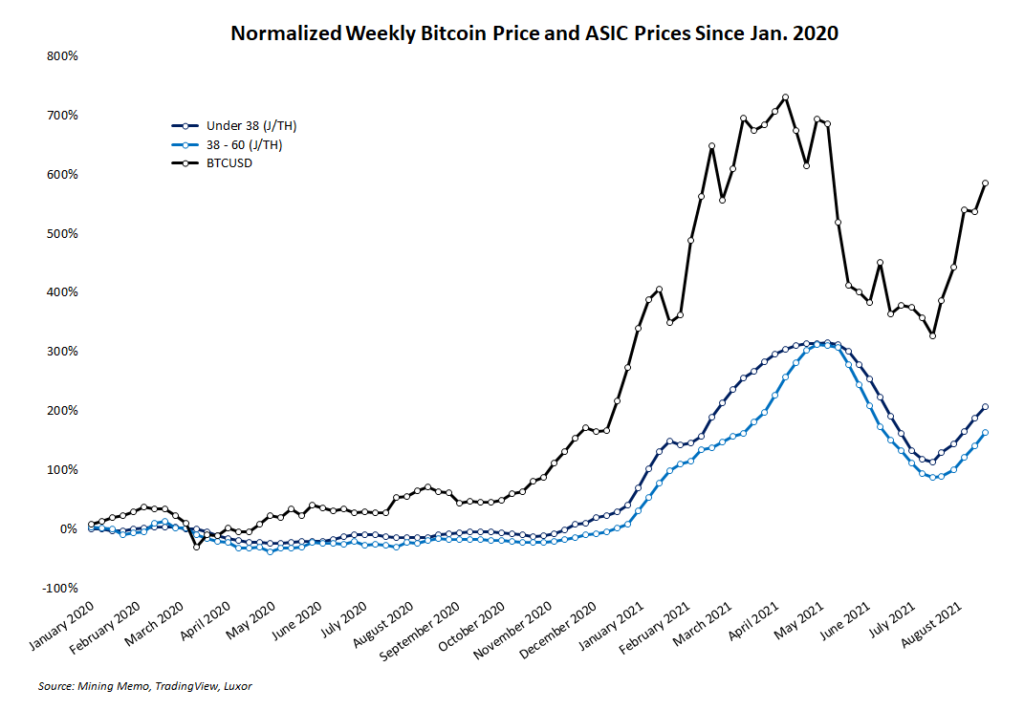

Compass Mining’s Zack Voell looked at the rapid rise in prices for mining equipment and he estimated that there has been a 25% increase in Q3 2021, a trend he attributes to the rising Bitcoin price.

In recent interactions with mining experts, it was deduced that ASIC prices will continue to track the price of Bitcoin, and as it has increased in recent weeks, so will platform price tags. A global chip shortage is the biggest manufacturing bottleneck driving ASIC prices up.

“ASIC miner prices always track the price of Bitcoin,” Blockstream CSO Samson Mow said. “The higher the price of Bitcoin, the higher the price of miners. [But] the other factor is the chip shortage, which is constraining supply. It’s possible that the supply of Bitcoin miners may never catch up to the demand.”

If Bitcoin’s price starts to dip significantly, ASIC prices will most likely follow despite the hoarding habits of some miners.

Recommend Read: A BREAKDOWN OF BITCOIN AND THE GAME THEORY

What’s Next for The ASIC Market?

While it is expected that Bitcoin will continue to go up, saying the same thing for ASICs would be an overstatement. It looks like the rise in the value of Bitcoin will continue to drive ASIC prices up, other factors also seem poised to influence the market.

In response to the latest chapter in China’s Bitcoin ban, including an executive order banning the sale of mining equipment inside the country, Chinese e-commerce giant Alibaba has announced that it will not sell plates -mining forms, or related accessories.

However, experts believe that the continuing China shutdown is not a major factor in the price of ASICs.

“The continuing China crackdown is great for Bitcoin decentralization but isn’t really affecting the price of ASICs,” reports said. “The ASIC market has detached itself from the China market and is much more affected by the ongoing global shortage of chips, which were not manufactured or sold in China in any case.”

The community is confident that ASIC sales and prices will improve in Q4 2021 and into 2022, mainly due to an improvement in chip availability. And ultimately, the BTC price will determine the price of the mining platform. A bearish outcome could be a nice gift for miners looking to procure more machines.

About Us

ImmuneBytes is facilitating blockchain security audit services by employing the use of cutting-edge techniques on smart contracts and decentralized applications. We have a team of experienced security professionals who are adept at their niches and provide you with innovative solutions and consultation. So far we have worked on 175+ blockchain start-ups on different blockchain frameworks, with clients spread across the globe, and are continually unfolding ourselves to make this decentralized movement thrive.

To know more, visit our website: immunebytes