Ever since people started getting interested in investing, awareness about the same has been increasing exponentially. Users have been devising new and innovative ways to ride different investment channels, especially millennials.

One such way in recent days has been peer-to-peer lending. The particular investment channel has been really popular among users of all ages. Peer-to-peer lending offers an edge over traditional lending methods.

In today?s article, we?ll be talking about this channel of investment, Peer-to-peer lending, and the global bank with a European base, ING, that has been leveraging this channel. Let?s get started!

Understanding Peer-to-Peer Lending

Table of Contents

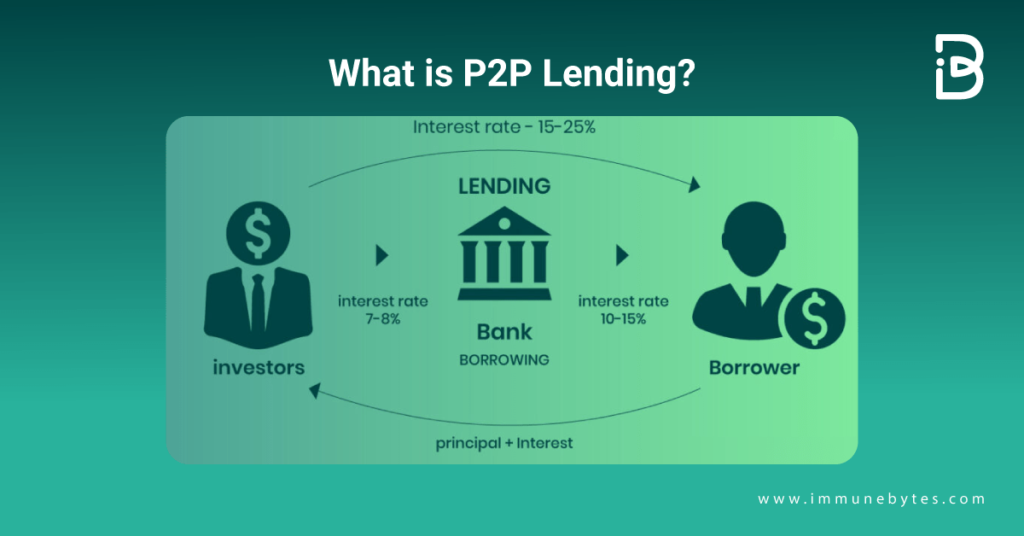

Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman.

Peer-to-peer lending also referred to as P2P lending, is an alternative financing method that allows individuals to avail of loans from other individuals through online lending platforms. Through these platforms, borrowers who seek unsecured personal loans can get in touch with investors who are willing to lend to them with the intention of earning a higher return on their investments.

The P2P lending platforms let investors go through a list of verified borrowers and their details before they lend to them.

Lenders can diversify their investments by lending to multiple borrowers in small amounts. Also known as crowdfunding or social lending, P2P lending is gradually gaining popularity among borrowers and investors around the world.

How Does Peer-to-Peer Lending Work?

Peer-to-peer lending is a mechanism that connects individuals in need of credit with others willing to lend. The platforms purely act as an intermediary or marketplace that connects borrowers and lenders.

Users can register as borrowers or lenders on any platform after undergoing a verification process by furnishing relevant details. As part of the process, borrowers will have to undergo a risk evaluation and pay a flat registration fee. Once registered, investors can reach out to the listed borrower.

All proposals are accepted on a first-come, first-serve basis. The rate of interest typically ranges from 10% to 28% and the loan tenure may range from 3 months to 36 months. Once an agreement is reached between the borrower and the lender, a legally-binding contract is signed by them digitally.

The loan amount is then transferred to the borrower?s account and the borrower makes periodic repayments via EMI over the stipulated period.

Four Things to Know About P2P Lending

Now that we know how P2P Lending works, let?s take a look at some of the things you must know before diving into it!

- P2P platforms do not evaluate borrowers based on credit scores. These perform their own set of checks to assess creditworthiness. Apart from usual checks around employment, income, credit history, etc., these rely extensively on tech to capture borrowers? habits by tracking social media activity, and app usage, among others.

- All P2P platforms come under the purview of RBI regulations. All players are required to register for an NBFC-P2P license to provide P2P lending services.

- These platforms are primarily used by individuals who do not meet the lending criteria prescribed by traditional lenders. The safety of your principal depends partly on the risk assessment capabilities of the P2P platform. Besides, the loans are unsecured.

- Do not blindly go by the interest rate on offer. Go through the borrower profiles carefully before approving any loan.

- Do not completely rely on the P2P platform?s risk assessment. For that reason, do not limit your exposure to a single borrower. Spread your outlay across multiple borrowers to reduce the impact of a default by a few. Monitor the borrower risk profile on an ongoing basis.

ING?s P2P Lending DeFi Project

According to ING?s Chief Innovation Officer, Annerie Vreugdenhil, ING is starting to work with the Netherlands financial regulatory AFM to potentially trial its DeFi P2P lending project as part of the AFM sandbox. The application won?t use Bitcoin or ?volatile? assets as collateral.

Vreugdenhil complimented Singapore?s regulatory environment, stating, ?In other places, we work with sandboxes that regulators have. We actually have in Amsterdam now an initiative on DeFi on P2P lending where we are starting to work with the regulator.?

Earlier this year, ING published a paper on Decentralized Finance (DeFi), particularly exploring the permissionless Aave peer-to-peer lending protocol.

No Bitcoin as collateral

ING?s solution would not support Bitcoin and hinted it might also exclude volatile cryptocurrencies. ?We are looking into peer-to-peer lending in a DeFi kind of setup. But then not on Bitcoins,? stated Vreugdenhil.

This leads to the question of what other standardized forms of assets might be offered.

The obvious candidates are:

- Securities

- Commodities currencies for foreign exchange

Concluding Thoughts

Alternative investments or asset classes like P2P lending may still be at a nascent stage, but their potential to grow is immense, considering how the millennial generation is pushing these services to the forefront of its financial agenda.

With P2P lending now being regulated by the RBI, the traction for this highly innovative and secure asset class is expected to see a massive rise in the near future.

About Us

ImmuneBytes is a Blockchain security firm that employs the industry?s best tools and practices to provide a comprehensive smart contract security audit. We have a team of robust and experienced security professionals who are adept at their niches and provide you with quality service. We have worked on 175+ projects spread across the world on different Blockchain frameworks with some of the industry?s top firms and we continue to unfold the decentralized movement.

We are also providing consultancy, coming up with a bug bounty platform, and also an insurance product to provide our clients with a hassle-free security product catalog. Stay tuned.